The All-In-One Rental Portfolio Management Tool That Saved Me 20+ Hours This Tax Season

3 Reasons to Use Stessa To Manage Your Portfolio

Happy Thursday, fellow Hybrids!

In today’s newsletter, I will share the tool I used to save 20+ hours this tax season, along with a quick overview on how it works.

(Today’s issue takes ~4 minutes to read)

Rental real estate is the most tax-advantaged income stream in existence.

But managing a rental portfolio comes with a massive headache come tax time.

My wife and I have acquired 8 rental properties in the last 5 years. Each year our taxes have grown more and more complex.

On average, I spent 3 hours a month + 20 additional hours at tax time on bookkeeping & tax prep alone. That's BEFORE I sent anything to our CPA.

Here are some highlights of my original not-so-brilliant bookkeeping system:

Saving paper receipts in a folder and not looking at them until tax time.

Taking wild guesses on how to categorize expenses and saving them in Excel (only for my CPA to clean them up later for $300/hour)

What I needed was a tool to centralize everything and view my portfolio in one place.

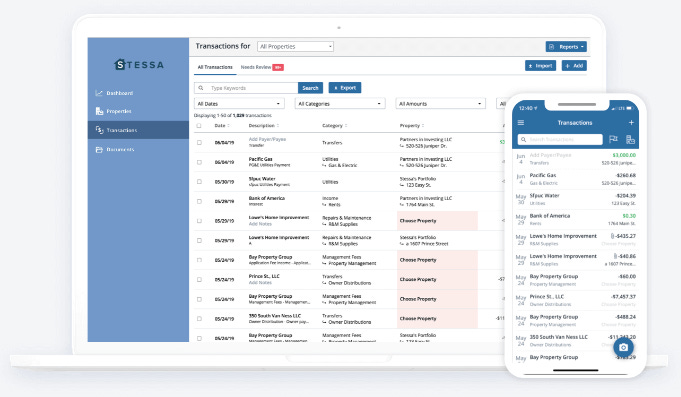

Introducing Stessa: A Reporting Solution for Landlords

Stessa (aka '“Assets” spelled backward) is a FREE tool that functions similarly to the ever-popular QuickBooks.

The difference is, Stessa is explicitly built for landlords.

All the categories are specific to real estate, and the user interface is brilliantly simple.

A Powerful Endorsement…

To further validate Stessa's usefulness, here's a testimonial from an experienced real estate investor (who also happens to be my Mother).

She has 20+ years of real estate investing experience, and here’s what she had to say about Stessa:

“From our campsite in Tucson, not far from the Mexican border, we are wrapping up the work we need to do for tax prep, including tidying up and exporting our Stessa transactions, and I can’t help but reflect on how much better life is with Stessa vs. Quickbooks. Andy and I both work in Stessa on a regular basis and keep it up to date way, way better than in the past because it’s so much easier to use and we can make updates from any device. So. Much. Better. Many thanks to you for bringing it to our attention.”

Wow…thats’ quite an endorsement. Plus, helping your Mom save time & enjoy her life is just a good thing to do, right?

Right!

Here are a few ways you can save yourself (or your Mom) time using Stessa:

Step 1: Build your portfolio to track Profit & Loss Statements (P&L) for each of your houses in real-time

Plug in your property info, and Stessa will give you an all-up view of your portfolio’s performance.

View your income, occupancy rates, debt service, cash flow & more, all with a straightforward dashboard view.

Step 2: Automate expense tracking & rental income

Why enter expenses manually when you can automate them?

Stessa links right to your bank account & credit card.

You can code expenses to the appropriate category, and Stessa will automatically learn that rule for future expenses.

Bookkeeping does not move the needle on your financial goals, so don’t spend any more time on it than is absolutely necessary.

Step 3: Export tax-ready reports to send to your CPA

When tax time comes, all you have to do is hit export & you'll have everything you need in hand. Your properties have already been tracked & coded correctly.

Click the button, and you (or your CPA) will have everything they need to file.

For extensive demo & tutorial videos, click here.

The features listed above are specific to accounting, but Stessa also has functionality for:

Rent Collection

Cash Management

Rental Applications

Document Storage

For a full list of services, you can click here to learn more.

NOTE: I am not paid by Stessa or affiliated with them in any way. I am simply a happy user looking to share a tool that has saved me a tremendous amount of time.

I hope you find Stessa as valuable as I have.

See you next week.

-Aaron

Wow, I'm flattered to be quoted about Stessa! We are definitely huge [also unaffiliated and uncompensated] Stessa fans. While I agree with you that bookkeeping doesn't move the needle on your financial goals, I do think that effective bookkeeping can save substantial money by ensuring that you're deducting all of the expenses you incur. For example, Stessa makes it super easy to deduct mileage, which we have often overlooked in the past.

We spent 30+ years as hybrid real estate professionals and were able to retire early in large part because of our rental property investments. I love that our son is following that path and that you're sharing your experience and knowledge with others in this newsletter!