Real Estate Investing 101: Why Business Operations Matter

Elevate Your Real Estate Game with Strong Business Operations Skills

Happy Thursday, fellow Hybrids!

In today’s newsletter, I will share key parallel skill sets from my job as an Operations Manager that equipped me to succeed in real estate investing and how you can use them too.

(Today’s issue takes ~3.5 minutes to read)

As a Hybrid Professional, you achieve the greatest success when you integrate your professional identities.

The key is to find work that allows you to exercise the skills in the sweet spot at the intersection of those identities.

For me, that sweet spot lies at the intersection between my day job in business operations & my real estate investing business.

To succeed as a real estate investor, you need to have a deep understanding of the business operations that go into managing and growing a real estate portfolio.

Here are some key skillsets I’ve developed through my full-time job as a Business & Operations Manager:

Budgeting and forecasting

Strategic decision-making

Managing financial accounts and reporting

Delegation & people management

Contracts review & administration

Utilizing key performance indicators (KPIs) to analyze data

Developing timelines and goal-setting strategies

Every single skill on this list has a direct application to real estate investing.

We'll look at the specific skills and knowledge you need to develop, and how you can leverage them to maximize your returns and achieve your investment goals.

Business Operations = “Running Your Business”

Here’s how each core component of my Operations job applies to real estate investing:

1) Budgeting and forecasting

Budgeting and forecasting help new real estate investors plan and allocate resources effectively, optimizing their investments and minimizing the risk of financial setbacks.

Learn More: Budgeting & Business Planning

2) Strategic decision-making

Choosing whether to invest $50k of your hard-earned money in a down payment qualifies as a high-impact strategic decision.

But learning to make strategic decisions is easier said than done. Take the time to learn how to break down tough decisions and align your actions with your goals.

Learn More: Strategic Decision Making

3) Managing financial accounts and reporting

By maintaining accurate financial records and reports, new investors can:

Track and analyze the financial performance of their investments.

Identify trends, risks & opportunities.

Make informed decisions about the allocation of resources and the pursuit of new investments.

Learn More: Thought Leadership - What Is Financial Reporting

4) Delegation & people management

Delegation is one of the highest-leverage skill sets out there.

We hired a VA firm this past October and it completely changed the trajectory of our real estate business. I now delegate my repeatable and teachable administrative work so I can focus on growth & strategy.

Learn More: I highly recommend our VA firm Accelstone.

There are no minimum hour requirements, they provide management support, and it’s $10/hour ($9 if you mention The Hybrid RE Pro).

More about Delegation: Tasks Every Real Estate Investor Should Be Delegating

5) Contract review & administration

Building a skillset in contracts administration helps investors:

Learn the finer details of your deals, reducing your risk of oversight.

Stay organized and keep track of important documents and deadlines.

Ensure compliance and avoid costly disputes and litigation.

Learn More: How To Efficiently Review Business Contracts

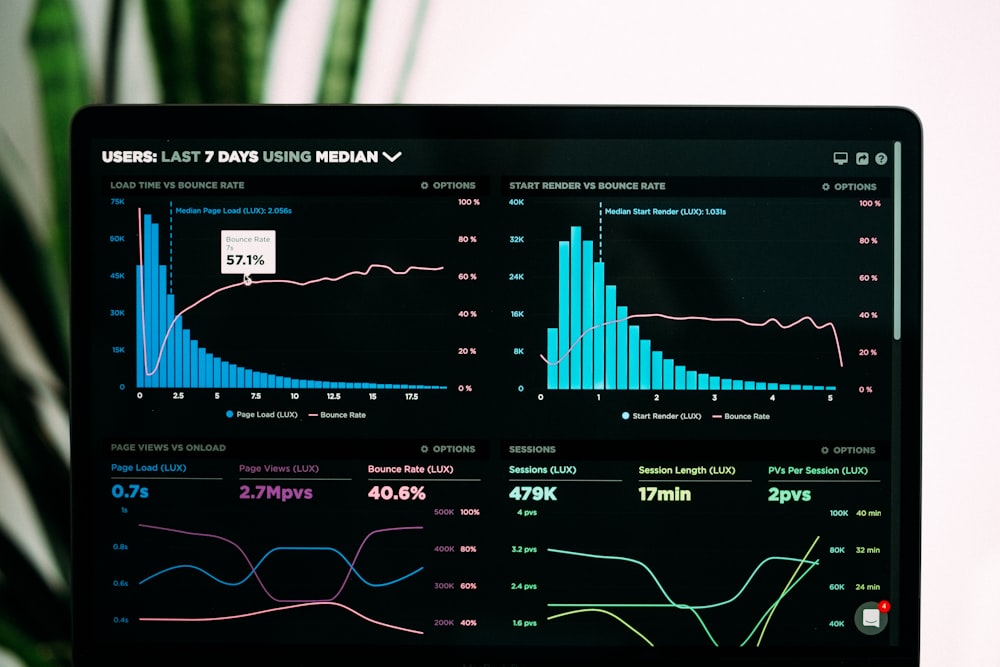

6) Utilizing key performance indicators (KPIs) to analyze data

Learning to interpret key performance indicators gives you a direct line of sight into the overall health of your business. Examples of real estate KPIs:

Occupancy rate: Measures the percentage of units in a real estate portfolio that are occupied by tenants. A high occupancy rate indicates strong demand, low occupancy rate may indicate issues with the quality of the properties, the pricing, or the marketing strategy.

Cash flow: This KPI measures the amount of cash generated by a real estate investment over a given period. Positive cash flow is critical for sustaining and growing a real estate portfolio and is calculated by subtracting expenses from rental income.

Return on investment (ROI): This KPI measures the amount of profit generated by a real estate investment relative to the initial investment.

Learn More: The Key Operational Metrics For Every Business Owner

7) Developing timelines and goal-setting strategies

Any good business has well-defined goals and timelines for reaching those goals. Whether you’re setting goals to grow your career or your rental portfolio, the skills are largely the same.

Learn More: Effective Goal-Setting: 7 Step Process For Success

By taking the time to learn these core business operations concepts, you will set yourself up to build a business that can scale over time.

I know these skills have served me well on my journey. Hope they can do the same for you.

See you next week.

-Aaron

PS: If you’re interested in learning more, I’m a reply or a quick 1x1 call away. I’d love to hear from you.