From Drum Sticks to Bricks: The Unlikely Lesson That Transformed My Investing Journey

Setting the Beat for Long-term Success in Real Estate

Happy Thursday, fellow Hybrids!

In this week's issue, I'm going to tell you about an unusual lesson I learned from my Jazz Studies Professor back when I was just a freshman drum student in college.

That lesson? "Avoid The Zipless F*ck"

Yes, you read that correctly, and no, it's not as explicit as you might think.

Before I dive in, let me assure you - this week’s newsletter is completely safe for work, despite the risqué phrasing.

Let’s jump in👇

(Today’s issue takes ~5 minutes to read)

Ok…what is the “Zipless F*ck?”

The Zipless F*ck - A concept that found its way into popular culture thanks to Erica Jong's 1973 novel, Fear of Flying. It's about a sexual encounter between strangers that’s spontaneous and free from strings or emotional entanglements.

But don’t worry, this article isn’t about sex.

Credit: Erica Jong, Fear of Flying, 1973

I will tell you how this concept, as I learned it from my professor, has everything to do with your journey as a hybrid real estate investor.

So how did the “Zipless F*ck” & music education mix?

Credit to my Jazz Studies Professor, Keith Brown, for weaving this concept into one of our private drum lessons.

I was 17 and a freshman drum student at the time, eager to elevate my drumming skills to unrealistic levels. Jazz was a genre I had virtually no experience playing, but I was impatient to be the best at it.

My professor, noticing my hasty approach, likened my aspiration to a "Zipless F*ck."

He told me, "Aaron, your goals aren't a one-night stand. They're more like a marriage. You need to court them, nurture them, and build them up over time. This journey is not a quick fling. It's a long, enduring commitment."

I had been rushing so much that I had been trying to skip the fundamentals. And we all know no matter what we’re pursuing in life, we need a solid foundation to succeed long-term.

While patience has never come easily to me, this wisdom has stayed with me since then.

What does this have to do with real estate investing?

Like mastering the art of playing jazz music, real estate investing is not a skill you can conjure up overnight.

You can't rush into investing without understanding the market, the risks, the potential gains, and a myriad of other factors.

Here are 4 ways to cultivate patience in your investing journey:

1/ Build the skill of delayed gratification:

It's tempting to want immediate results from your investments.

But remember, real estate investing requires a vision for the future.

When I was an impatient drum student, I had to stop rushing things and put in the work. I practiced upwards of 7 hours a day!

Translated to real estate investing, I analyze at least 10 deals per week if I want to get a pulse on a local market. (You can analyze deals in 5-minutes or less with DealCheck. Learn how here.)

Only by absorbing the information on a regular cadence over a long period of time can you truly understand what works in a market.

So don’t forget to put in the reps. The experience you gain will make you a better investor in the long run.

2/ Foster a mindset of continuous learning:

The real estate market is constantly changing.

Make it a point to continually educate yourself about the fundamentals of real estate investing & keep a pulse on your local market conditions.

Reading industry reports

Check out my new favorite daily real estate market trends email - ZeroFlux

Watching YouTube videos

Engaging with fellow investors

BiggerPockets Forums is a good FREE starting point

Attending seminars and webinars

In Person: BP Con (I don’t recommend this unless you’re really committed. It’s pricey, but there are networking opportunities galore)

Online: BiggerPockets has several FREE webinars to get you started

Level up your knowledge & network to level up your returns.

3/ Accept that juggling a job, family, and investing requires careful time management

As a hybrid investor, you must respect that your time is divided.

Given all the areas of your life competing for your attention, you need discipline & structure. I highly recommend setting aside “Sacred Hours” to work on your real estate goals.

Sacred Hours ensure you have time to make progress on your goals without compromising your ability to be present for your career & family.

You won’t see results overnight, but you WILL over a longer time horizon.

Click here to view the Ideal Week Template, including a blueprint of how I set up my week. I encourage you to make a copy and build your own ideal week!

Make it a point to continually educate yourself about the fundamentals of real estate.

4/ Understand that real estate investing is a marathon, not a sprint:

Patience in real estate investing is akin to understanding that wealth builds gradually.

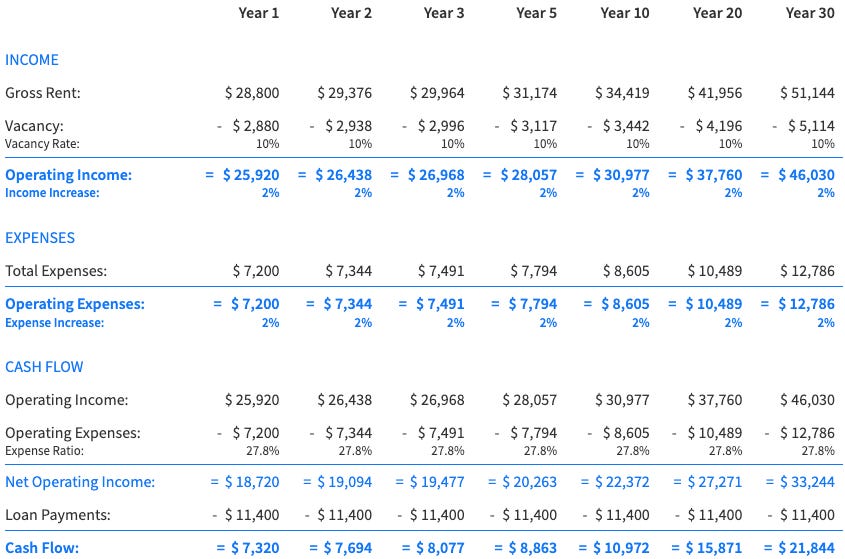

Take this illustration of a simple rental property over time.

Assumptions:

$250k purchase price w/ 25% down payment

4.5% interest rate, 30-year fixed loan

Expenses ~25% of rental income (increases 2% per year)

10% of rent budgeted for vacancy on top of that

Year 1 rent at $2,400/month (increases 2% per year)

Here’s how that looks:

After 10 years your net cash flow increased by 50% while your equity position almost tripled ($62,500 to $185,811)!

The further you get into your loan, the faster your principal paydown is.

Now THAT is powerful.

Conclusion

The key takeaway here is that success in real estate investing doesn't come from the "Zipless F*ck" approach.

It's not a quick fling but a long-term commitment that requires patience, understanding, and care.

Remember, slow and steady wins the race.

See you next week.

-Aaron

PS: Ready to jump-start your real estate investing journey? Book a FREE 45-minute strategy call here to discuss your unique situation and create an action plan.